Amortization

- Financial Term Glossary

- Amortization Schedule

Amortization Schedule

Amortization schedule summary:

An amortization schedule is a detailed timeline for paying off an installment loan.

An amortization schedule shows that interest charges are heaviest at the beginning of your payment history, when the balance is larger.

Extra payments have the greatest impact early in a loan term.

Amortization schedule definition and meaning

A visual breakdown of installment loan amortization, including the total number of payments that will be made, when each payment is due, and how much of each payment is applied to the principal and interest.

In a typical amortization schedule, a larger percentage of each payment goes to interest charges in the early part of the repayment period. Toward the end of repayment, a larger percentage of each payment is applied to the principal balance.

An amortization schedule is a convenient way to keep track of your approximate payoff balance after each payment.

Key components of an amortization schedule:

Original amount borrowed

Interest rate

Loan term

Payment amount

Payment frequency (if it’s not there, assume it’s monthly)

Total number of payments

Running balance after each payment is made

Total amount repaid

Total interest over the life of the loan

Amortization schedule comprehensive breakdown

An amortization schedule is a list of all the payments that will be made on an installment loan, and how each payment will be split between interest and principal. Details you’ll see on an amortization schedule typically include:

Original amount borrowed

Interest rate

Loan term

Payment amount

Payment frequency (if it’s not there, assume it’s monthly)

Total number of payments

Running balance after each payment is made

Total amount repaid

Total interest over the life of the loan

Amortization schedule: real-life example

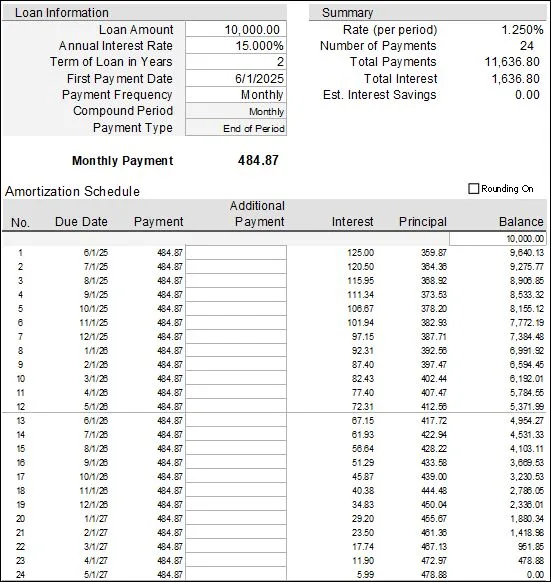

Here’s an example. Let’s look at a $10,000 personal loan. The interest rate is 15% and the repayment term is two years. The monthly payment is $484.87.

If we were to opt for a longer repayment term, the monthly payment would be lower but the total amount of interest would go up.

One of the first things you’ll notice on an amortization schedule is that at the beginning of a loan, more of your payment goes to interest. That’s because your balance is bigger, and interest charges are based on how much you owe.

Besides showing you how much interest you’ll pay each month, the amortization schedule shows you the total amount of interest you’ll pay overall.

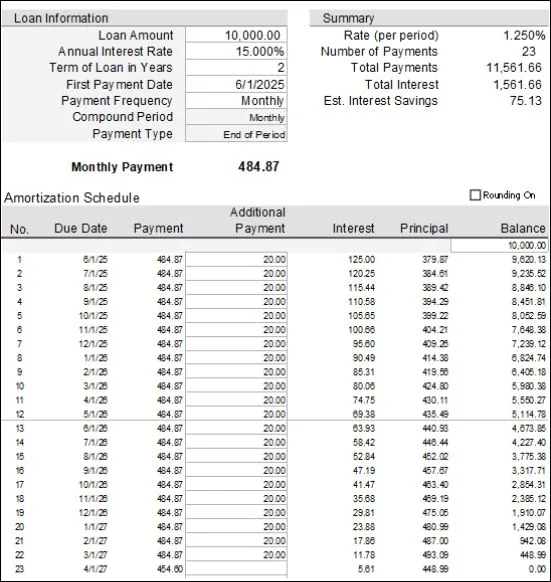

If you can afford to make an extra payment, you could reduce your total loan cost and speed up your loan payoff, even without adding piles of extra cash to your payments. In this example, if you pay an extra $20 per month, you’ll shave a month off the timeline and save more than $75 in interest charges.

Enter different amounts into an amortization table to see what happens.

For example, if you send an extra $500 with the first payment, and then make regular payments after that, you’ll pay off the loan in month #23 and save $163 in interest.

But let’s say you make regular payments for 20 months. When you see that your balance is down to around $1,880, you feel energized to pay it off faster, so you send an extra $500 with payment #21. You’ll still pay off the loan in month #23, but you’ll only save $18.56 in interest. That single payment for an extra $500 has a far greater impact earlier in the life of the loan. You’ll see these details on your loan amortization.

If you’re considering making any extra payments toward your principal balance, make sure your lender won’t charge you a prepayment penalty, which is a fee for paying off a loan ahead of schedule.

Amortization Schedule FAQs

Loan costs primarily center on two things: Interest and fees. The interest rate on a loan represents the cost of borrowing money. Interest rates are largely determined by your credit history, though lenders may consider other factors when setting your rate. Fees—such as origination fees, application fees, credit check fees, late fees, or prepayment penalties—can add to your loan cost. The best ways to save money on loan costs are improving your credit to qualify for lower rates and choosing a lender that charges minimal fees.

If you make extra payments and your lender applies them to your principal balance, you could pay off your loan ahead of schedule. Use an amortization schedule to figure out how much extra you would need to pay to clear the debt by the deadline you set.

Sometimes. The principal balance is the amount you borrow. Your total loan balance may or may not just be the principal; it could also include interest, loan fees, or both. What you currently owe is sometimes referred to as the current balance or outstanding balance.

If you’re making an extra payment, it’s generally better to pay down the principal, since that will reduce how much you owe. That should make your future interest payments smaller and help you pay off the loan faster, too.

Related Articles

Installment loans offer a smart way to borrow money—with fixed payments and simple repayment terms. Learn how they work.

Learn what “principal” means on a loan, how it differs from interest, and how payments reduce your principal balance over time. Includes clear examples.

Use a personal unsecured loan from Achieve, with no collateral, to consolidate high-interest rate debt, make home improvements, or fund a large purchase. Apply now.