Return to Press Room

Achieve study finds higher incomes obscure the financial strain on households struggling with debt

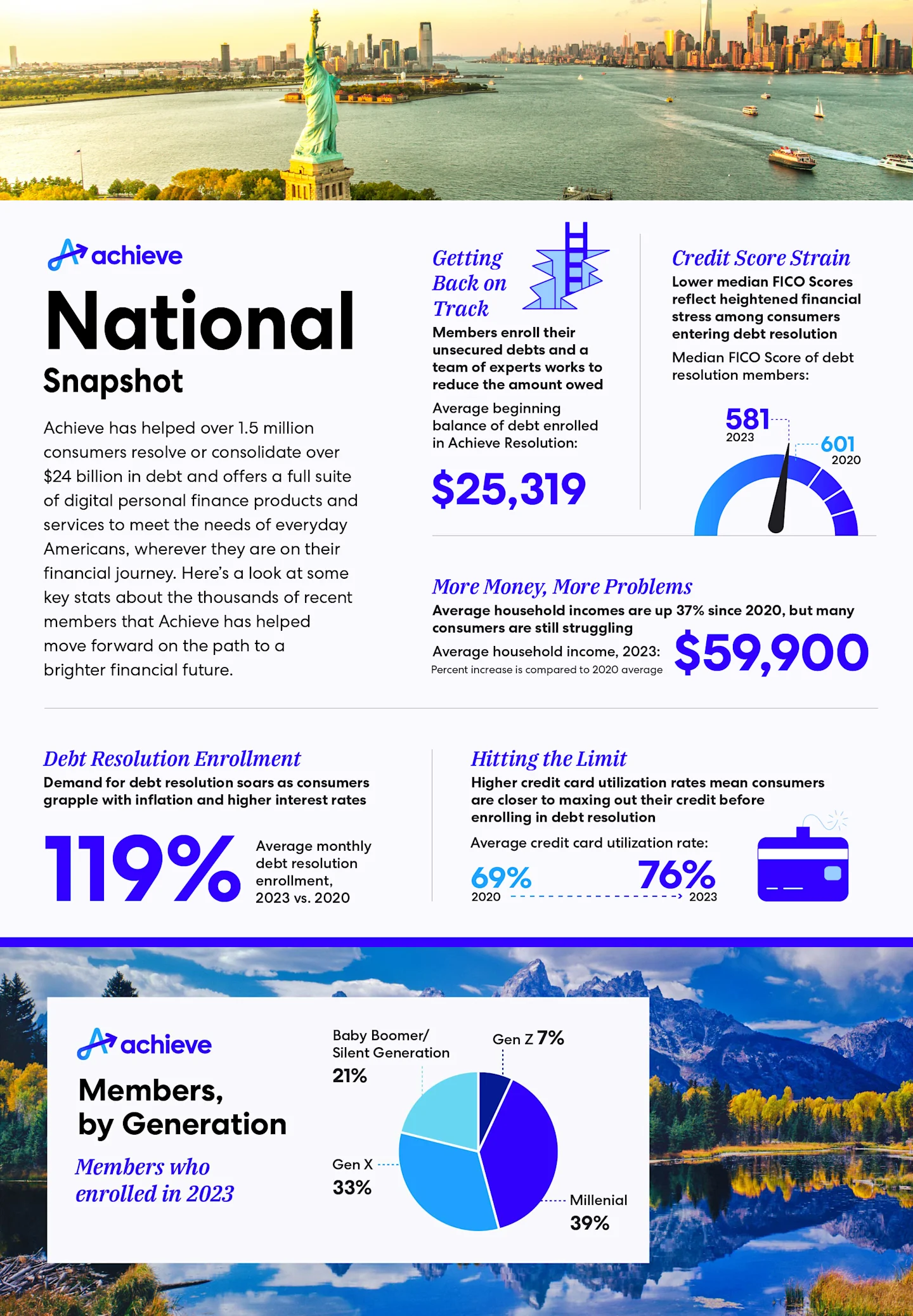

Achieve data shows household incomes are growing, but consumers enrolling in debt relief have lower credit scores, higher credit card utilization rates and tend to be younger than in previous years.

October 30, 2023

SAN MATEO, Calif., October 30, 2023 — Despite a significant rise in household incomes, consumers struggling with debt are often in worse shape and further behind financially now than those who were dealing with these issues during the pandemic, according to a new study by Achieve, the leader in digital personal finance.

To examine how the profile of consumers who are struggling with debt has evolved since the pandemic, Achieve analyzed consumers who sought help with their finances by enrolling in debt relief in 2020 and 2023. The study found that while median household incomes are higher, these consumers also have lower credit scores, higher credit card utilization rates and tend to be younger.

Income — The Great Resignation phenomenon that emerged during the early recovery from the pandemic resulted in higher wages for many Americans, and debt relief members are no exception. The average household income of debt relief members was $59,900 through the first nine months of 2023, up 37% from $43,598 in 2020.

Credit Card Utilization — The ratio of outstanding debt to total available credit on revolving accounts like credit cards is a key factor in assessing financial stress and one of the most influential factors used to calculate consumer credit scores. The credit card utilization rate of debt relief members was 76% in 2023, compared to 69% in 2020.

Credit Score — Consumers who enrolled in debt relief in 2023 have a median credit score of 581, compared to a median score of 601 in 2020. While the typical debt relief member is still within the “Fair” range of credit scores, this shift is indicative of the heightened strain consumers are facing.

Age — The typical age of debt relief members has decreased since the pandemic, with a median age of 44 in 2023, compared to 52 in 2020. Achieve believes this is the result of two factors: more consumers falling behind financially earlier in their lives, and a stronger motivation to seek out help before debt problems worsen. This trend is further demonstrated by shifts in the generational breakout of Achieve’s debt relief members.

“When consumers reach out to Achieve’s certified debt consultants, it’s often the first time they’ve talked to anyone else about their financial challenges,” said Achieve Co-Founder and Co-CEO Andrew Housser. “There is still a strong stigma around debt that often results in hesitancy to take action, but that is slowly starting to change.”

The shifts in consumer profiles come as demand for debt relief is soaring. Average monthly enrollment in debt relief is 119% higher in 2023 than it was in 2020. And this growth doesn’t include consumers who aren’t a good fit for debt relief and are referred to other debt solutions like debt consolidation, bankruptcy, credit counseling and digital personal finance tools like the free Achieve MoLO (Money Left Over) mobile app.

In 2023, the average member enrolled $25,319 in debt, compared to $27,327 in 2020. One metric that has remained constant over this time is the number of financial accounts held by debt relief members: Members enroll an average of eight unsecured credit report tradelines when they begin debt relief and have a total of 15 open tradelines on their credit reports.

“Government stimulus provided an essential financial lifeline to consumers struggling during the pandemic, but that support has been winding down at the same time that consumers are dealing with a historic surge in inflation and a challenging interest rate environment,” said Housser. “That’s contributed to the surge in consumer demand for help addressing debt. With the recent end of federal student loan forbearance, this trend is unlikely to subside anytime soon.”

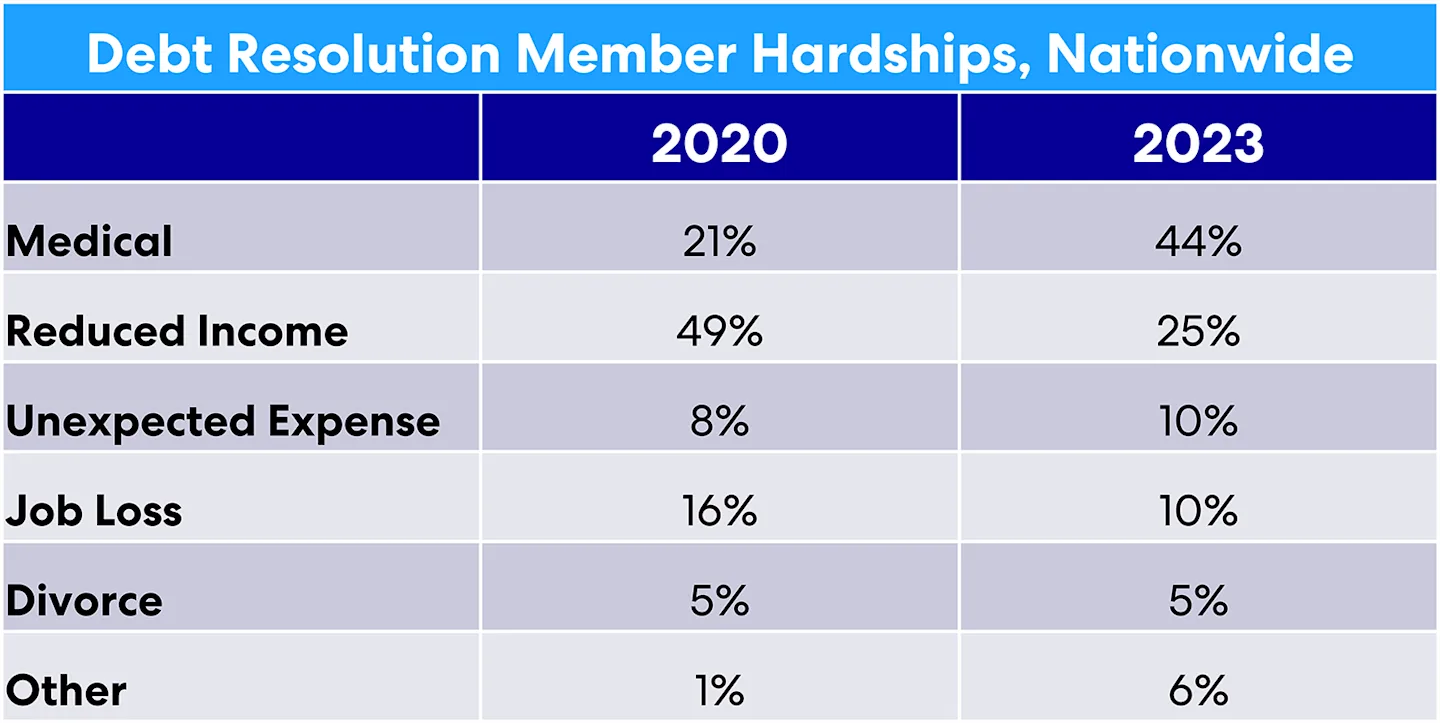

Consumers must have a demonstrated financial hardship to qualify for a debt relief program like Achieve Debt Relief. Many consumers who enroll in debt relief are getting by financially before a life-changing event like a medical issue or loss of income puts them in a situation they can’t recover from on their own. While income reduction was the leading hardship for consumers in 2020, medical issues are now the predominant challenge for consumers who enroll in debt relief.

The study was conducted by the Achieve Center for Consumer Insights, a think tank that publishes research and commentary in support of Achieve’s mission of helping everyday people get on, and stay on, the path to a better financial future. In addition to the analysis of nationwide debt relief trends, the Achieve Center for Consumer Insights has published a series of Debt Relief State Snapshot reports for the following states:

Methodology

The data and findings presented are based on a representative sample of the over 200,000 active members enrolled in debt relief products and services offered by Achieve and its affiliates. Annual comparisons are based on monthly averages for full-year 2020 and Jan.-Sept. 2023. To date, Achieve has served over 1.5 million customers and has resolved or consolidated over $24 billion in debt.

More from Achieve

Achieve invests in top talent with appointment of Chief Operating Officer and Chief Security Officer

About Achieve

Achieve, THE digital personal finance company, helps everyday people get on, and stay on, the path to a better financial future. Achieve pairs proprietary data and analytics with personalized support to offer personal loans, home equity loans and debt relief, along with financial tips and education and a free mobile app, Achieve MoLO (Money Left Over). Achieve has 3,000 dedicated teammates across the country with hubs in Arizona, California, Florida and Texas. Achieve is frequently recognized as a Best Place to Work.

Achieve refers to the global organization and may denote one or more affiliates of Achieve Company, including Achieve.com (NMLS ID #138464); Achieve Home Loans, Equal Housing Lender (NMLS ID #1810501); Achieve Personal Loans (NMLS ID #227977); Achieve Debt Relief (NMLS ID # 1248929) and Freedom Financial Asset Management (CRD #170229).

Contacts

Erica Bigley

Vice President, Corporate Communications

415-710-9006

Austin Kilgore

Director, Corporate Communications

214-908-5097