Return to Press Room

From digital dollars to real-world debt: 31% of parents catch their kids on unapproved online shopping sprees

New survey by Achieve finds children overspend their allowances, sneak digital purchases and struggle to grasp the value of money in a cashless world

September 15, 2025

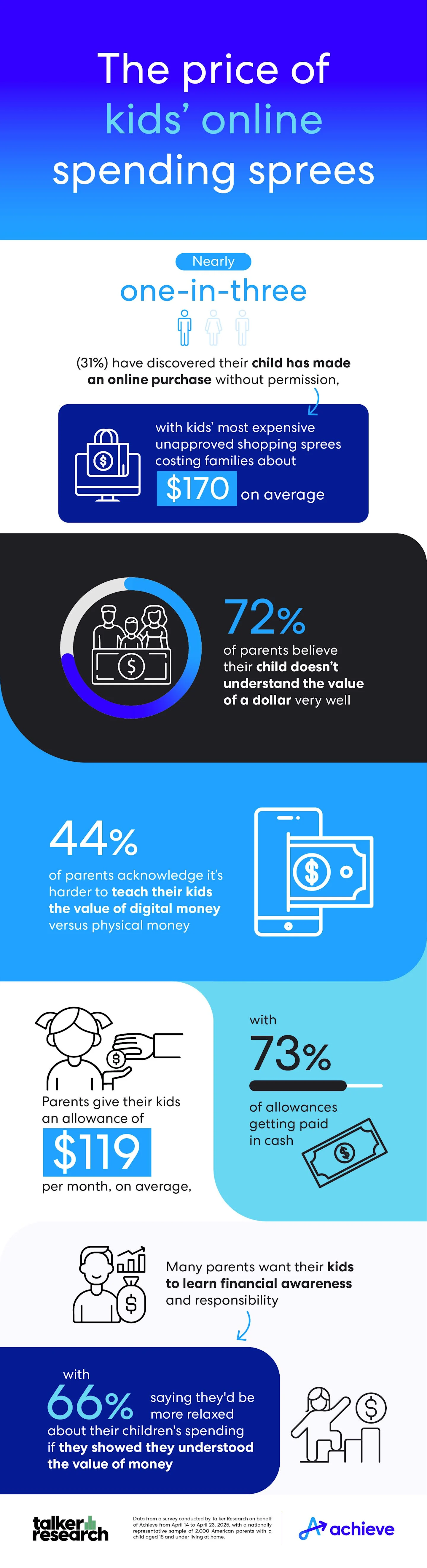

SAN MATEO, Calif., Sept. 15, 2025 — Families across America are learning the hard way that the “click to buy” culture isn’t just draining adult wallets. A new survey by Achieve, the leader in digital personal finance, reveals that 31% of parents have caught their kids making unapproved online purchases. This surprise spending costs parents $170 on average, while 19% of parents report costs of over $300 — proof that small clicks can snowball into big expenses.

The study of 2,000 parents of children 18 and under was conducted by Talker Research. It paints a broader picture of how children interact with money, and how families struggle to teach lasting lessons about financial responsibility. Parents reported that these surprise charges aren’t limited to video games and fashion items. Some kids went bigger, buying computers, smartphones, smart watches, cameras and even dabbling in stocks and cryptocurrency. The findings underscore the financial blind spots created by a generation of kids growing up with instant digital transactions. Other key findings include:

When kids overspend, parents most often start with a conversation (56%), but some resort to taking away a device (23%) or demanding repayment (20%).

65% of parents always require their kids to ask before making online purchases, while 11% of parents report rarely or never require permission.

When asked to compare their children’s level of financial responsibility to their own at the same age, 39% of parents say their children are more responsible, 18% say their children are less responsible and 43% believe it’s about equal.

Oversight Gaps Leave Families Vulnerable

Despite the risks, many parents admit they aren’t monitoring their kids’ financial habits closely. Almost one-quarter (23%) rarely or never check their child’s debit or credit card activity, while 11% say they rarely or never require permission before digital purchases. At the same time, most parents recognize the educational gap, with 44% admitting it’s harder to teach financial lessons with digital money than with physical cash.

“Money lessons used to start with piggy banks. Now they start with passwords and apps, with parents scrambling to keep up,” said Achieve Co-Founder and Co-CEO Brad Stroh. “Kids today are spending faster than their parents can keep track of, often without realizing the consequences of increased digital access to banking and commerce. That disconnect between clicks and costs is a challenge many families face.”

Allowances Don’t Curb Overspending

The survey also revealed how families are trying, but often failing, to use allowances as teaching tools. More than half of parents (57%) give their children a regular allowance, usually paid in cash (73%). The typical monthly payout is $119, but 14% of kids receive more than $250. Despite those budgets, overspending is widespread: only 12% of parents say their kids never exceed their allowance.

While over half (56%) of parents respond to unapproved spending with a conversation, parents also turn to firmer steps, including returning the purchase (27%), confiscating a device (23%), grounding (21%), demanding repayment (20%) or freezing account access (11%). Yet two-thirds of parents (66%) admit they’d relax if they believed their kids understood the value of money, and 61% even wish a financial expert could step in to teach healthy spending habits.

Why It Matters

Unapproved online spending may seem like a quirky family problem, but the stakes are higher. Kids who don’t learn financial limits early may struggle later with debt, credit, and long-term financial health. Allowances and conversations alone aren’t enough in an economy where nearly every purchase is digital.

The survey findings suggest that American families are caught between convenience and control. Digital tools make spending easy, but they also make financial education urgent. As unapproved purchases pile up, parents have both a challenge and an opportunity: to prepare their children for a financial future where every tap carries weight.

“We can’t expect children to understand money on their own. Families, schools and experts all have a role to play in building the next generation’s financial skills,” Stroh said. “The best way forward is for parents and mentors to stay engaged, set boundaries, and use every unexpected charge as a chance to build lifelong money skills.”

Methodology

Talker Research surveyed a nationally representative sample of 2,000 American parents with a child aged 18 and under living at home; the survey was commissioned by Achieve and administered and conducted online by Talker Research between April 14 and April 23, 2025.

About Achieve

Achieve, THE digital personal finance company, helps everyday people get on, and stay on, the path to a better financial future. Achieve pairs proprietary data and analytics with personalized support to offer personal loans, home equity loans, debt resolution and debt consolidation, along with financial tips and education and free mobile apps: Achieve MoLO® (Money Left Over) and Achieve GOOD™ (Get Out Of Debt). Achieve has 2,300 dedicated teammates across the country, with hubs in Arizona, California, Florida and Texas. Achieve is frequently recognized as a Best Place to Work.

Achieve refers to the global organization and may denote one or more affiliates of Achieve Company, including Achieve.com, Equal Housing Opportunity (NMLS ID #138464); Achieve Home Loans, Equal Housing Opportunity (NMLS ID #1810501); Achieve Personal Loans (NMLS ID #227977); Achieve Resolution (NMLS ID # 1248929); and Freedom Financial Asset Management (CRD #170229).

Contacts

Austin Kilgore

Director

Corporate Communications

214-908-5097

Elina Tarkazikis

Manager

Corporate Communications