Return to Press Room

58% of Americans say their finances are in crisis, Achieve survey finds

The reality check Americans can’t cash: New data from Achieve reveals rising financial pessimism and growing debt stress.

August 04, 2025

SAN MATEO, Calif., August 4, 2025 — Over half of Americans (58%) rate their current financial situation as either “Poor” or “Fair,” a sign of growing discontent as the struggle to cover the costs of everyday expenses is leading many consumers to accumulate debt, according to the results of the latest survey by Achieve, the leader in digital personal finance.

Among survey respondents with a favorable view of their finances, just 10% gave themselves an “Excellent,” rating, while 31% view their situation as “Good.” The share of respondents with a negative outlook of their finances is up from 50% in Achieve’s second-quarter 2025 survey.

“Many American households are facing a fundamental income-expense mismatch, which is leading them to rely on debt to get by,” said Achieve Co-Founder and Co-CEO Brad Stroh. “This isn’t just a numbers game; it's a profound moment where people are losing confidence in their ability to stay afloat and manage their household finances. The goal shouldn’t just be to manage from month to month; it's to break free and build lasting financial stability.”

The June 2025 survey was conducted by Achieve’s think tank, the Achieve Center for Consumer Insights, and complements the Federal Reserve Bank of New York’s upcoming Quarterly Report on Household Debt and Credit by providing qualitative insights into consumer borrowing and debt. Key findings from the latest edition of Achieve’s study include:

55% of those surveyed use credit cards to cover essential expenses, with 26% of these respondents carrying this debt for six months or longer.

45% estimate they could pay off their outstanding unsecured debt in six months or less, while 18% would need between six months and one year and 37% said it would take them more than one year to pay off all their short-term debt.

22% added to their overall debt load over the past three months, while 34% decreased their total debt.

67% report paying all their bills on time over the past three months, up from 59% last quarter and 60% one year ago. However, 35% of all respondents say they face difficulty maintaining on-time debt payments.

Paychecks can’t keep up — and the bills don’t wait

Few consumers point to a single impediment affecting their ability to pay debts on time. However, among consumers grappling with paying their debts on time, three themes are prevalent: insufficient income to cover spending (70%); owing on too many different accounts (30%); and difficulty with cashflow timing between receiving income and meeting payment due dates (25%). This comes at a period of economic uncertainty due to tariffs, with peak consumer debt and elevated interest rates applied to those debt burdens.

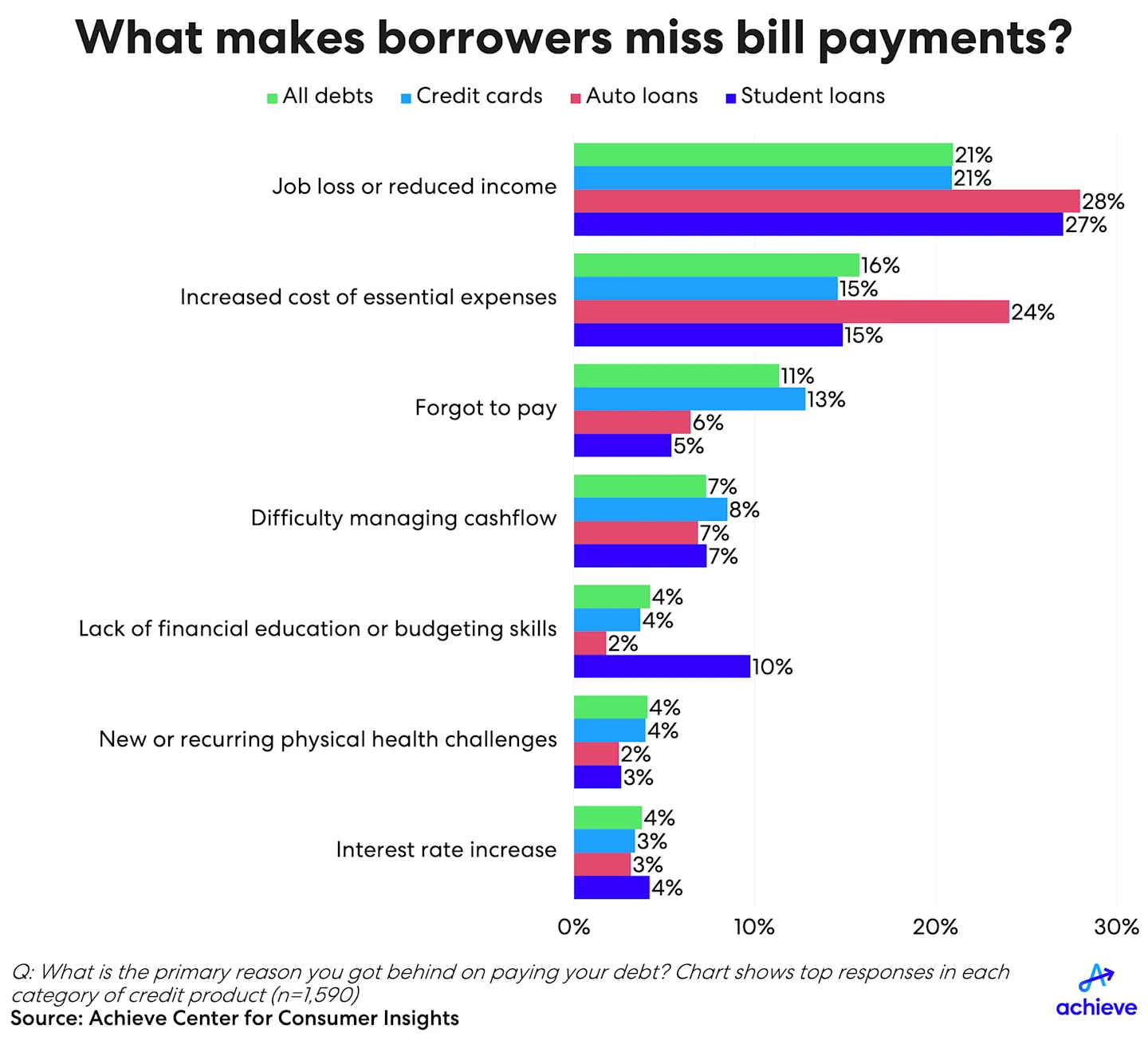

This pattern continues in situations when consumers who are struggling to keep up with their financial obligations have to miss bill payments. Unexpected job losses and income reductions are the leading cause of missed payments across most categories of debt, followed by higher costs and financial literacy challenges.

Gap between consumer optimism and reality grows

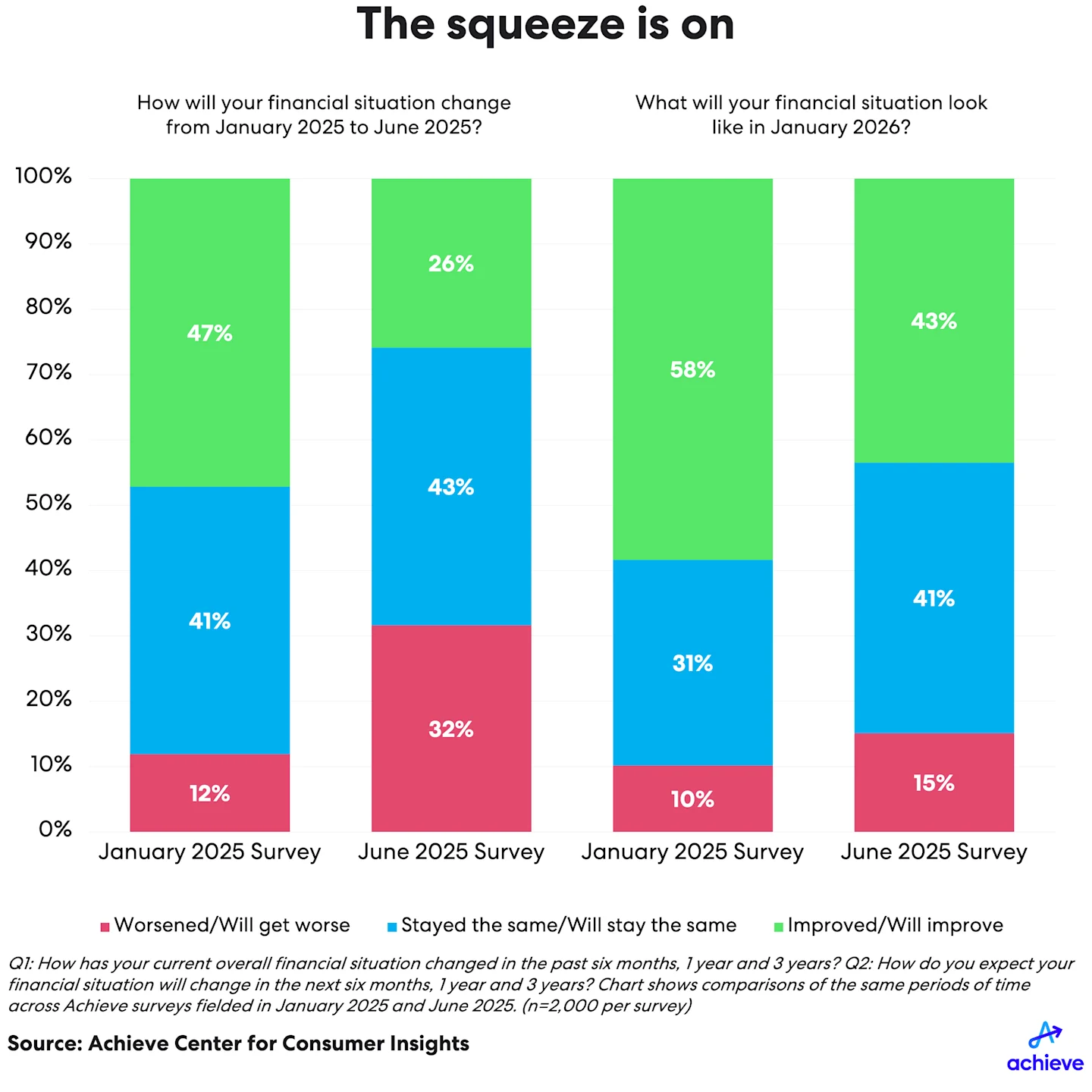

The last edition of Achieve’s household debt and credit survey highlighted a growing rift between consumers’ financial expectations and their economic reality. That trend continues in Achieve’s latest survey, revealing a drastic fall-off in consumers’ expectations about the future.

In Achieve’s January 2025 survey, just 12% of respondents predicted their financial situation would worsen by the middle of the year. But in the June 2025 survey, 32% of respondents now say their finances have deteriorated over the first half of the year. This setback comes at the expense of the nearly half of all January survey respondents who predicted their situation would improve by midyear.

“This economic uncertainty has led many consumers to reset their expectations for the future,” Stroh said. “At the same time, consumers appear to be adjusting their spending habits in response to these economic pressures and in anticipation of future price increases that are growing faster than wage gains for many Americans.”

Looking ahead, many consumers now appear to be bracing for stagnant, if not outright worse, economic conditions for the remainder of 2025. Achieve’s latest survey found that 43% of respondents predict their financial situation will be better in January 2026 than it is right now. That’s a steep decline from the results of the January 2025 survey, when 58% predicted their situation will be better in January 2026.

Methodology

The data and findings presented are based on an Achieve survey conducted in June 2025 consisting of 2,000 U.S. consumers ages 18 and older with an active account for one or more of the following categories of consumer debt: auto loan; major credit card with a minimum outstanding balance of $100; first-lien mortgage; home equity line of credit (HELOC); student loan; and other (unsecured personal loan, store-branded credit card, buy now, pay later loan, or closed-end home equity loan). The sample was augmented to include a statistically significant subset of credit card, auto loan and student loan borrowers who have been 30 days or more past due at least once in the past six months.

About the Achieve Center for Consumer Insights

The Achieve Center for Consumer Insights is a think tank that leverages Achieve’s team of digital personal finance experts to provide a view into the state of consumer finances. In addition to sharing insights gleaned from Achieve’s proprietary data and analytics, the Achieve Center for Consumer Insights publishes in-depth research, bespoke data and thoughtful commentary in support of Achieve’s mission of helping everyday people get on the path to a better financial future.

About Achieve

Achieve, THE digital personal finance company, helps everyday people get on, and stay on, the path to a better financial future. Achieve pairs proprietary data and analytics with personalized support to offer personal loans, home equity loans, debt resolution and debt consolidation, along with financial tips and education and free mobile apps: Achieve MoLO® (Money Left Over) and Achieve GOOD™ (Get Out Of Debt). Achieve has 2,300 dedicated teammates across the country, with hubs in Arizona, California, Florida and Texas. Achieve is frequently recognized as a Best Place to Work.

Achieve refers to the global organization and may denote one or more affiliates of Achieve Company, including Achieve.com, Equal Housing Opportunity (NMLS ID #138464); Achieve Home Loans, Equal Housing Opportunity (NMLS ID #1810501); Achieve Personal Loans (NMLS ID #227977); Achieve Resolution (NMLS ID # 1248929); and Freedom Financial Asset Management (CRD #170229).

Contacts

Austin Kilgore

Director

Corporate Communications

214-908-5097

Elina Tarkazikis

Manager

Corporate Communications